nordmulti.ru

Market

Moving 401k From Previous Employer

Call the k custodian for your former employer. Tell them you are going to roll it over to your new employers k. They will give you the. Transfer the funds into a Rollover IRA; Cash out your (k); Transfer the money to your new company's plan. There are specific considerations for and against. Before rolling over your (k), compare plans between your old and new employer. · It's typically best to opt for a direct versus indirect rollover. · If you. A (k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. (k) Rollover Real Talk · If your (k) balance is modest (less than $5, for some plans), your former employer may remove you from their plan and send you. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. Keep your (k) with your former employer. Roll over the money into an IRA. Roll over your (k) into a new employer's plan. Cash out. If you. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or. Call the k custodian for your former employer. Tell them you are going to roll it over to your new employers k. They will give you the. Transfer the funds into a Rollover IRA; Cash out your (k); Transfer the money to your new company's plan. There are specific considerations for and against. Before rolling over your (k), compare plans between your old and new employer. · It's typically best to opt for a direct versus indirect rollover. · If you. A (k) rollover transfers assets from your previous employer's plan directly to another tax-deferred account. (k) Rollover Real Talk · If your (k) balance is modest (less than $5, for some plans), your former employer may remove you from their plan and send you. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. Keep your (k) with your former employer. Roll over the money into an IRA. Roll over your (k) into a new employer's plan. Cash out. If you. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or.

If your previous employer disburses your (k) funds to you, you have 60 days to rollover those funds into an eligible retirement account. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. If your previous employer disburses your (k) funds to you, you have 60 days to rollover those funds into an eligible retirement account. You may want to move assets from your old (k) to your current employer's (k) plan to keep them all in one place. The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you'll pay. Transferring to a New Employer's Plan. If you start a new job that offers a (k) plan, you can transfer your old (k) into your new employer's plan. This. Why Move Your Old (k)? Your previous employer could require you to move your (k) out of their plan. They may not want to manage the cost and. 4 options for your old (k) · 1. Roll over to Fidelity IRA. Roll over to Fidelity and consolidate your retirement accounts in one place while continuing tax-. What are my options for my (k)? · Option #1: Leave it in your former employer's (k) plan, if allowed by the plan. · Option #2: Move it to your new. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. If you leave your (k) with your old employer, you will no longer be allowed to make contributions to the plan. It will still be invested as it was and you. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may. Depending on your circumstances, if you roll over your money from your old (k) to a new one, you'll be able to keep your retirement savings all in one place. Inform your former employer that you want to roll over your (k) funds into an IRA. Make sure the check is payable to the financial services company, instead. You can ask the plan administrator of the old (k) account to transfer the (k) balance directly into the new employer's plan. You can also ask the plan. Leave the money in your former employer's plan, if permitted · Roll over the assets to the new employer's plan if one exists and rollovers are permitted · Roll. If you have a new employer, you may be able to — if the new employer's plan allows it — roll the money from your former employer's plan into your new employer's. If your new employer offers a (k) plan that matches part of your contributions, you may want to consider rolling over the assets from your old plan into your. If you don't already have a rollover IRA, you'll need to open one—this way, you can move money from your former employer's plan into this account. If there. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA.

Find Dividend

Simply use the formula D = DPS multiplied by S, where D = your dividends and S = the number of shares you own. Remember that since you're using the company's. This tool allows you to calculate an estimate of your dividend payment, based on the number of shares you owned when the dividend was paid. The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share (EPS), or equivalently, or divided by net income. This calculator assumes that all dividend payments will be reinvested. Money Invested. $. Return Rate. %. Number of Years. Calculate My Returns. Few companies issue preferred stock. Computing dividends per share. A company must first calculate its per-share earnings for the period (quarter or year). Click the Dividend ExDate column header a second time to reverse the order of the sort (ascending: smallest to largest value). This will put the nearest. Dividend = Divisor x Quotient + Remainder. Usually, when we divide a number by another number, it results in an answer, such that;. x/y = z · Example 1: Find the. Use our dividend calculator to calculate the value of your latest dividend. The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Simply use the formula D = DPS multiplied by S, where D = your dividends and S = the number of shares you own. Remember that since you're using the company's. This tool allows you to calculate an estimate of your dividend payment, based on the number of shares you owned when the dividend was paid. The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share (EPS), or equivalently, or divided by net income. This calculator assumes that all dividend payments will be reinvested. Money Invested. $. Return Rate. %. Number of Years. Calculate My Returns. Few companies issue preferred stock. Computing dividends per share. A company must first calculate its per-share earnings for the period (quarter or year). Click the Dividend ExDate column header a second time to reverse the order of the sort (ascending: smallest to largest value). This will put the nearest. Dividend = Divisor x Quotient + Remainder. Usually, when we divide a number by another number, it results in an answer, such that;. x/y = z · Example 1: Find the. Use our dividend calculator to calculate the value of your latest dividend. The Dividend History page provides a single page to review all of the aggregated Dividend payment information.

Most companies pay quarterly dividends. For such companies, the annualized dividend per share = 4 x quarterly dividend per share. How To Calculate Dividend. dividend payout ratio. Related definitions. Common shares · Earnings after tax · Find out more in our glossary. Didn't find what you were looking for? Back to. Dividend Payments. Dividends on common stock are normally paid quarterly on If you are unable to locate all of your certificates, please contact. Whether it's through dividend stocks or dividend funds, reinvesting those dividends Find a dividend-paying stock. You can look for stocks that pay dividends. For companies that pay a dividend, you can calculate dividend yield by dividing the expected income (the dividend) by what you invest (the price per share). You can use the following formula on how to calculate dividends per share: Dividend Per Share (DPS) = Annualised Dividend ÷ Number of Shares Outstanding. Discover the latest dividend announcements and historical data for stocks listed on the Nasdaq We couldn't find any results matching your search. Please try. Over time I have developed five benchmarks that I use to find dividends that increase the dividend payout annually. I look for companies. Out of $20, in earnings after tax (EAT), the company pays $10, to shareholders as dividends (at a dividend payout ratio of 50%). To find out more. The dividend payout ratio is the total amount of dividends that a company pays to shareholders relative to its net income. Calculating the Dividend Payout Ratio in Excel. If you are given the sum of the dividends over a certain period and the outstanding shares, you can calculate. Get the actual past and estimated future annual rate and yield of an investment. Learn where to find the forward and trailing dividend info in the Yahoo. Calculate your dividend in US dollars for the most recently declared HSBC dividend announcement and for the year to date. nordmulti.ru can search for a stock and then go to the Dividend Tab you can see Dividend History charted out. How to calculate required annual dividend on preferred stock? Every preferred dividend comes with a percentage rate, so all you need to do is multiply that. Find common share information including dividends, dividend re-investment plan, closing share prices etc. Find us on Facebook. State of Alaska Department of Revenue. For corrections, or if any link or information is inaccurate or otherwise out-dated, please email. Calculate Dividend Per Share (DPS) on an Annualized Basis · Retrieve the Issuer's Share Price as of the Latest Closing Date · Divide the Issuer's Dividend Per. How to calculate required annual dividend on preferred stock? Every preferred dividend comes with a percentage rate, so all you need to do is multiply that.

Where To Get Money With Bad Credit

Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates money—or having low usage. Bad credit business loans - low credit small business funding: apply for Great funder, fast approvals, great technology company putting money on the street. How to get a loan with no credit or bad credit · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit. Yes, it is possible to get a loan with no credit or bad credit, but lenders will likely charge you a higher interest rate than if you had established credit. MoneyMutual: A Trusted Source for Borrowers with Low Credit Scores MoneyMutual is dedicated to providing individuals with poor credit history access to find. If you are looking for loans for bad credit in AZ, feel free to walk in anytime or schedule a visit for the fastest title loans in Arizona. No Repayment Penalty. OppLoans online loan platform offers installment loans to middle-income consumers, who may have bad credit or no credit. Here is additional information for. credit score requirements for bad credit emergency loans. Some lenders will accept a FICO credit score as low as , and others have no minimum credit score. Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one below , but most personal. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates money—or having low usage. Bad credit business loans - low credit small business funding: apply for Great funder, fast approvals, great technology company putting money on the street. How to get a loan with no credit or bad credit · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit. Yes, it is possible to get a loan with no credit or bad credit, but lenders will likely charge you a higher interest rate than if you had established credit. MoneyMutual: A Trusted Source for Borrowers with Low Credit Scores MoneyMutual is dedicated to providing individuals with poor credit history access to find. If you are looking for loans for bad credit in AZ, feel free to walk in anytime or schedule a visit for the fastest title loans in Arizona. No Repayment Penalty. OppLoans online loan platform offers installment loans to middle-income consumers, who may have bad credit or no credit. Here is additional information for. credit score requirements for bad credit emergency loans. Some lenders will accept a FICO credit score as low as , and others have no minimum credit score. Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one below , but most personal.

Why Choose American Loan Company For Your Bad Credit Loans in Ohio? · No Payments For 40 Days – First 10 days interest FREE – Use promo 40DAYS · Bad credit. bad credit loans even with a poor score. What is a Bad Credit Loan? A bad credit loan is a personal loan that's designed specifically for people with poor. Eagle Express Loan Quick, no credit check loan up to $ for qualifying members. Eagle Express Loans. Need a little extra cash? We have two Eagle Express. So, how do you qualify for a low APR personal loan? One way is to take a bad credit loan and utilize it as a way to boost your credit score. Another could be to. How to get a personal loan with low credit; Alternatives to bad credit loans; Expert advice for bad credit loans; FAQs; Methodology. Filter & Sort. Filter. Low, fixed-rate loans; Borrow up to $; Money can be used for any purpose; No closing fees; Minimum credit score required – +; day repayment terms. Loans for Bad Credit in · Best for small loan amounts: Upgrade Personal Loan · Best for easy qualification: Avant Personal Loan · Best for low credit scores. Cash money does a line of credit. I'd try that over a payday loan A very bad idea if you're depending on money that isn't guaranteed. A bad credit personal loan is a loan for consumers with no or low credit scores. This type of loan usually offers a fixed interest rate and is repaid in fixed. Advance America offers loan options to borrowers with bad credit, fair credit, or no credit. What we look for is your ability to repay what you borrow, which. Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. Getting loans for bad credit has never been easier than with MyChoice. You can apply online and get an answer within minutes—and your money within hours. When. Key Takeaways · Home equity loans allow property owners to borrow against the debt-free value of their homes. · If you have bad credit, you may still be able to. payments if you have bad credit Running low on funds could mean late bill payments, an empty refrigerator at home and/or no gas money to get to work! Although there is no official definition of "good" "fair" or "bad" credit scores, “bad credit” has become widely used to refer to low scores—or those that. Tips for improving your chances of getting a loan with bad credit · Apply with a co-signer or co-borrower. · Opt for a smaller loan amount. · Consider secured. Even with bad credit, you can still qualify for some emergency loans Low interest personal loans for everything from your wedding to home improvements. CASH 1 offers loans for bad credit or no credit in Utah. You can qualify for $50 up to $ Please apply online or call at and GET CASH. If that is not possible, an auto title loan (if you have a car worth $ or more), or a private personal loan (from a hard money lender). Lending Bear stands out in the market by offering installment loans in Tennessee that cater to individuals with bad credit.

Best Boat Lenders

The best rates on the market We work closely with more than 21 respected marine lenders to get the best possible rate for each boat loan. And we maintain. New/Used Boat Fixed Rate ; up to 36 months, % ; months, % ; months, % ; months, % ; months, %. We evaluated personal loan lenders and specialized boat lenders on rates, fees, terms, and more. SoFi is our top choice for an unsecured boat loan. Tropical Financial Credit Union is here to help you get beyond your boat buying journey. Get started on financing your boat loan with low rates & terms. UFirst Credit Union is one of the largest boat financiers in Utah. As a reputable member-owned financial institution, we provide people like you with affordable. New Boat Rates ; , up to 60 months, $5,, % to % · $5, - $10, ; , 61 to 72 months, $15,, % to % · $15, - $10, ; Greater Texas Credit Union is your source for low-interest boat loans in Texas. Get out on the open water at a great rate today. Learn more or apply online. We finance boats of any year. Whether it's for a cabin cruiser, motor yacht, sailboat, wooden boat, something new or an 80 year old classic, JJ Best will. If you've got good credit, you've earned a great rate on an unsecured boat loan from LightStream. Get the financing you need to get the boat you want. The best rates on the market We work closely with more than 21 respected marine lenders to get the best possible rate for each boat loan. And we maintain. New/Used Boat Fixed Rate ; up to 36 months, % ; months, % ; months, % ; months, % ; months, %. We evaluated personal loan lenders and specialized boat lenders on rates, fees, terms, and more. SoFi is our top choice for an unsecured boat loan. Tropical Financial Credit Union is here to help you get beyond your boat buying journey. Get started on financing your boat loan with low rates & terms. UFirst Credit Union is one of the largest boat financiers in Utah. As a reputable member-owned financial institution, we provide people like you with affordable. New Boat Rates ; , up to 60 months, $5,, % to % · $5, - $10, ; , 61 to 72 months, $15,, % to % · $15, - $10, ; Greater Texas Credit Union is your source for low-interest boat loans in Texas. Get out on the open water at a great rate today. Learn more or apply online. We finance boats of any year. Whether it's for a cabin cruiser, motor yacht, sailboat, wooden boat, something new or an 80 year old classic, JJ Best will. If you've got good credit, you've earned a great rate on an unsecured boat loan from LightStream. Get the financing you need to get the boat you want.

MarineMax Boat Financing MarineMax, the world's largest and most trusted recreational marine dealer, has formed partnerships with leading lenders within the. OceanPoint Marine Lending, a division of BankNewport, is a recreational financing company dedicated to helping customers make their dream of boat and RV. Boat Loans ; Boat Loan Calculator by Discover Boating. Boat Loan Calculator. Boat Loans by Boat US ; LightStream for Best Loan Experience Guaranteed. Best Loan. Your local credit union is a good first stop, though national credit unions also offer boat loans. Navy Federal and First Tech, for example, both offer boat. A closer look at our top boat loan lenders · Upstart: Best for low credit · Upstart: Best for low credit · Achieve: Best for consolidating boat loan debt · Achieve. OceanPoint Marine Lending, a division of BankNewport, is a recreational financing company dedicated to helping customers make their dream of boat and RV. MMFCU RV Loan and Boat Loan Perks. Hand using a tablet. Easy Payments. You can make loan payments however it suits you best. Set up auto withdrawals, have us. Best Boat Loans at SCCU At SCCU, you can count on competitive interest rates and flexible terms with your boat financing for new or used vessels, including. We can finance standard boats up to 20 model years old, call for boats up to 25 model years old. Do you offer a zero down program. Innovative loan features like Anytime Skip-A-Pay, GAP coverage, Debt Protection, and no origination fees make Seattle Credit Union's Boat Loans among the best. Trident Funding is one of the largest and most experienced financing companies in the US, specializing in Boat, Yacht, RV & Aircraft Loans. Our vast knowledge. Discover boat loan options with Arkansas Federal Credit Union. We offer affordable payments, % financing, and a $0 application fee. As of September , the best interest rates for boat loans typically start around %. Of course, these rates fluctuate with market conditions, inflation. We offer loans for powerboats, sailboats, multi-hull boats, pontoons, and even personal watercrafts. Use our Boat Loan Calculator to determine a monthly payment. When I bought my current boat I ended up using the financing through the dealership.. They gave me their "best" rate and then I told them my. Know what you can spend so you can shop with confidence for a new or used boat. Your U.S. Bank boat financing pre-approval is good at any of our participating. New & Used Boat Loans ; 60 Months · % · $10, ; 90 Months · % · $30, ; Months · % · $40, ; Months · % · $50, The lending provider offers personal loans for Boat Purchase customers at fixed APRs. Therefore, you can receive funding from Best Egg free of hassles or. We offer competitive, fixed rates as low as % APR. How do I apply for boat financing? Cope Marine, Inc. has a full-service finance department with over 25 years of financing experience. We work with national and local lenders to help you get the.

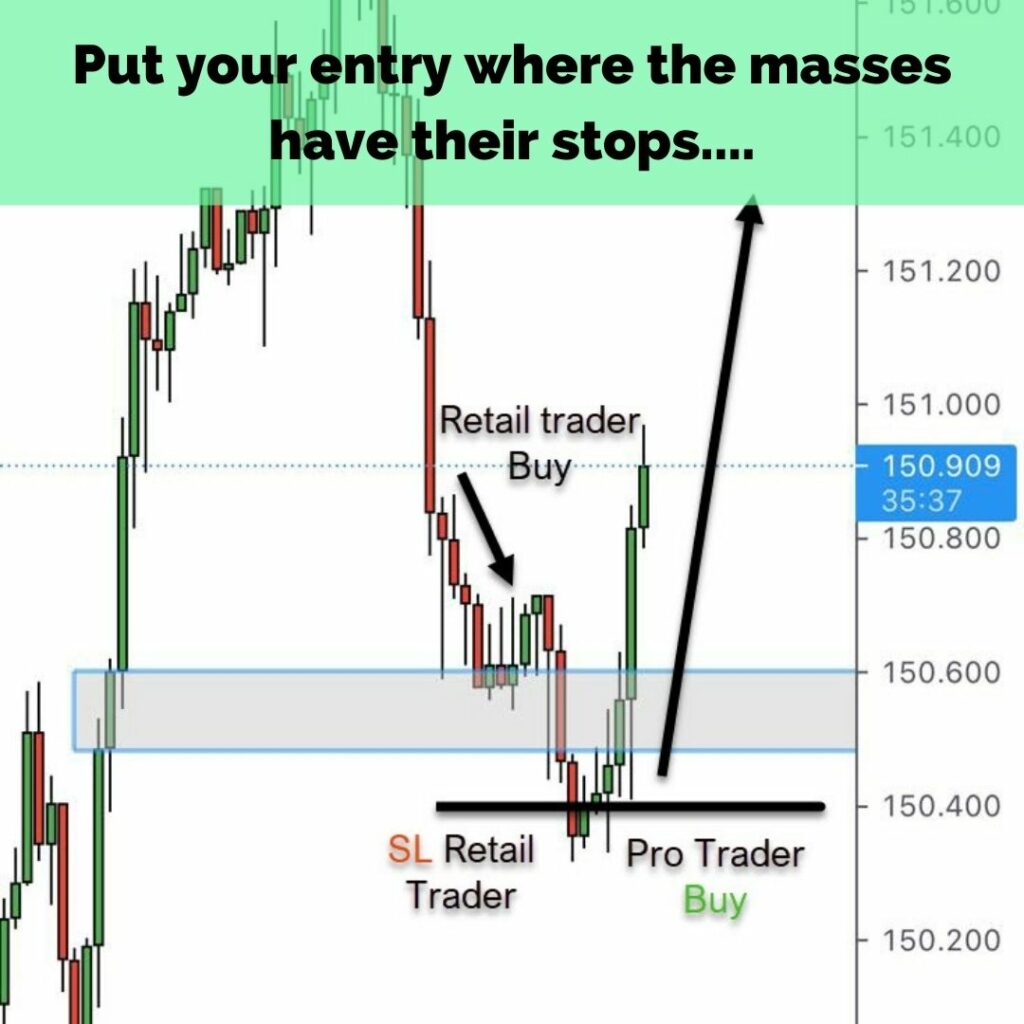

Smart Money Trading Forex

Market Manipulation. Smart money traders have the ability to manipulate market prices through sizable orders or well-coordinated trading operations. They might. SMART MONEY CONCEPT SMART MONEY TRADING CONCEPT IS A GROUP CREATED TO HELP EVERY TRADER EXPERIENCE AND NON EXPERIENCE TO UNDERSTAND EASILY HOW TO MAKE. Forex traders can utilize the Smart Money Concept to their advantage by tracking the actions and market sentiment of large institutional. Dive into the world of Forex trading with our comprehensive guidebook! In this book, we unveil the power of combining the Smart Money Concept with Supply and. Dec 6, - Explore UD FOREX Signal Service's board "smart money concepts" on Pinterest. See more ideas about money concepts, smart money, forex trading. Smart Money Concept: Forex Trading Techniques for Individual Trader (Paperback) This book is harder to get and may take several weeks if available. Please. Smart Money trading refers to the use of institutional trading strategies which are aligned with the perspectives of Smart Money. Institutional Smart Money. The Smart Money Concept (SMC) in forex trading is a technical analysis strategy that centers on tracking and responding to the trading actions of institutional. Smart money refers to investments made by experienced investors, such as institutional investors, hedge funds, or private equity firms, with a proven track. Market Manipulation. Smart money traders have the ability to manipulate market prices through sizable orders or well-coordinated trading operations. They might. SMART MONEY CONCEPT SMART MONEY TRADING CONCEPT IS A GROUP CREATED TO HELP EVERY TRADER EXPERIENCE AND NON EXPERIENCE TO UNDERSTAND EASILY HOW TO MAKE. Forex traders can utilize the Smart Money Concept to their advantage by tracking the actions and market sentiment of large institutional. Dive into the world of Forex trading with our comprehensive guidebook! In this book, we unveil the power of combining the Smart Money Concept with Supply and. Dec 6, - Explore UD FOREX Signal Service's board "smart money concepts" on Pinterest. See more ideas about money concepts, smart money, forex trading. Smart Money Concept: Forex Trading Techniques for Individual Trader (Paperback) This book is harder to get and may take several weeks if available. Please. Smart Money trading refers to the use of institutional trading strategies which are aligned with the perspectives of Smart Money. Institutional Smart Money. The Smart Money Concept (SMC) in forex trading is a technical analysis strategy that centers on tracking and responding to the trading actions of institutional. Smart money refers to investments made by experienced investors, such as institutional investors, hedge funds, or private equity firms, with a proven track.

Master Smart Money Concept Forex Trading | Learn the Secret of the Market - Unlock the knowledge to excel in forex trading! Plus, gain access to our private. In this second video, we will look at LIQUIDITY POOL- · Smart money hides in forex market · or where banks want to manipulate the market. · Watch the video over. Forex traders can use the concept of smart money to their advantage by trying to follow the actions of these large entities. By tracking their. 1. The document discusses key concepts used by experienced traders called "smart money concepts". These concepts help understand market movements and make. You can do bottom-up analysis and create a market hypothesis based on intraday price action. Of course, every trader should understand the. Smart money concepts is the methodology about how the marker makers trade AKA the smart money. · The smart money are the banks / hedge funds /. As a rule, smart money refers to the capital controlled by professional traders, institutional investors, and market insiders with extensive experience and. SMC introduces specific terminology, including Order Blocks, Fair Value Gaps, and Liquidity, which are key elements in analyzing market movements. These. Smart Money refers to institutional investors, professional traders, and other well-informed market participants who are believed to have a deep understanding. The capital that institutional investors, central banks, and other professionals or financial institutions control is referred to as smart money. It is handled. It works not only Forex, Crypto market, It also works well on Stock market. So, If we have knowledge with Smart Money Concepts, It will be the big advantaged to. Smart Money Trading Strategy 2: Taking Advantage of Traps A second strategy that allows you to trade with the smart money, uses another FXSSI indicator called. You will learn the only forex trading strategy you need to stand out from 90% of the traders and to make significant profits. Explained concepts with animated. Forex traders can use the concept of smart money to their advantage by trying to follow the actions of these large entities. By tracking their. Institutional investors and traders buy and sell a lot of currencies. They use supply and demand to move prices. This is called the Smart Money trading. Followers, 61 Following, Posts - Smart Money Forex Trading (@fxplained) on Instagram: "Fundamentals | Institutional Viewpoint | Not Selling. Uncover how the Smart Money operates. Learn from basic to advanced knowledge of Institutional Forex trading. Discover how you can weaponize this knowledge and. Algorithmic Traders. Traders who employ automated systems to execute trades. They can use SMC principles to program their algorithms to recognize patterns. Forex trading bears intrinsic risks of loss. You must understand that Forex trading, while potentially profitable, can make you lose your money. Never trade. In Forex trading, to track smart money, investors can analyze data sources such as CFTC filings, volume analysis, insider trading reports.

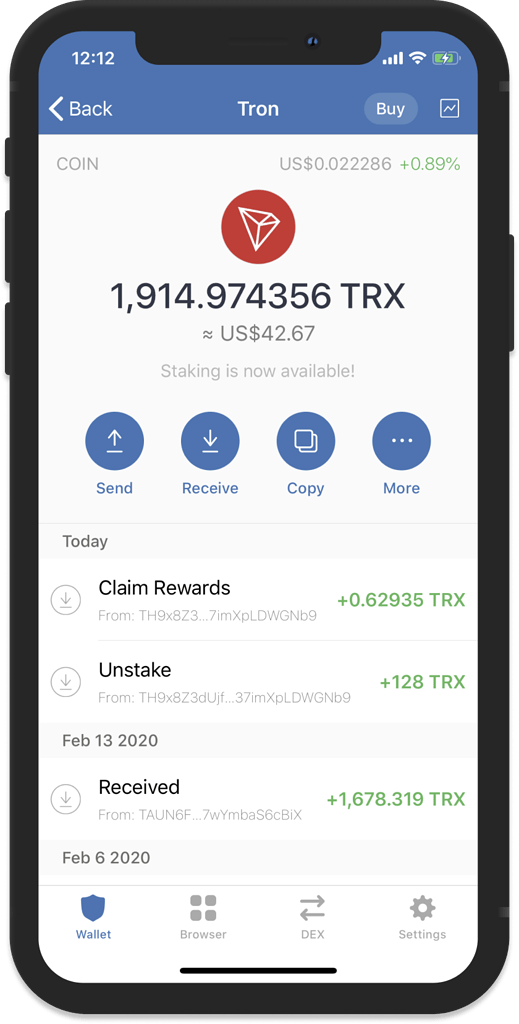

How To Stake On Trust Wallet

How to stake DOT · Open Trust Wallet and select Earn. · Search for DOT and select it. · Select Stake. · Choose the Amount to stake. · Select Validators . Earning #crypto in #TrustWallet with staking is super easy! Plus, we have loads of options & some of the best APR% around, with more options. Any wallet closed source is potentially a risk. You should never stake any crypto. Just hold em in any good wallet open source, your own seed. How staking works in Trust Wallet · Select the “More” button and then choose “Stake”. · On the Staking page, select “Stake”. · Choose the amount you want to stake. How to Stake #Solana via Trust Wallet (iOS, Android) This guide is an easy walk-through for you to start earning ~% APR for your staked SOL in This means that Orbs token holders can now stake their ORBS tokens directly from their Trust wallet application. How to Stake ORBS Using the Trust Wallet. Trust Wallet Rewards Calculator · 1. Asset. Trust Wallet TWT. Trust WalletTWT. Explore more Assets. ⚠️ This is not the actual reward rate for TWT Staking. This. Calculate Trust Wallet Token staking rewards. Find best rates for TWT from exchanges like ReHold, Bybit, Binance using this Trust Wallet Token calculator. Step-by-step · 1. Obtain Trust Wallet Token (TWT) tokens. In order to stake Trust Wallet Token, you need to have it. · 2. Choose a Trust Wallet Token wallet. How to stake DOT · Open Trust Wallet and select Earn. · Search for DOT and select it. · Select Stake. · Choose the Amount to stake. · Select Validators . Earning #crypto in #TrustWallet with staking is super easy! Plus, we have loads of options & some of the best APR% around, with more options. Any wallet closed source is potentially a risk. You should never stake any crypto. Just hold em in any good wallet open source, your own seed. How staking works in Trust Wallet · Select the “More” button and then choose “Stake”. · On the Staking page, select “Stake”. · Choose the amount you want to stake. How to Stake #Solana via Trust Wallet (iOS, Android) This guide is an easy walk-through for you to start earning ~% APR for your staked SOL in This means that Orbs token holders can now stake their ORBS tokens directly from their Trust wallet application. How to Stake ORBS Using the Trust Wallet. Trust Wallet Rewards Calculator · 1. Asset. Trust Wallet TWT. Trust WalletTWT. Explore more Assets. ⚠️ This is not the actual reward rate for TWT Staking. This. Calculate Trust Wallet Token staking rewards. Find best rates for TWT from exchanges like ReHold, Bybit, Binance using this Trust Wallet Token calculator. Step-by-step · 1. Obtain Trust Wallet Token (TWT) tokens. In order to stake Trust Wallet Token, you need to have it. · 2. Choose a Trust Wallet Token wallet.

Find and compare the best Crypto Staking platforms for Trust Wallet in · 1. 1inch Wallet Reviews. Top Pick. 1inch Wallet · 2. PancakeSwap Reviews. In this guide we will be guiding you through the process of staking Tezos(XTZ) using the Trust wallet. Adding money to the Trust Wallet app is very simple. All that the users need to do is log in to their wallet account and click on the “Receive” button and paste. Trust Wallet Tax Reporting · Automatically sync your Trust Wallet account with CoinLedger by entering your public wallet address. This allows your transactions. Trust Wallet allows for seamless Ethereum staking using Lido. Follow the guide below to get started. Trust Cryptocurrency Wallet Review · Supports over 10 million digital assets · Easy setup · Non-custodial · In-app decentralized exchange · Available staking options. You can check out these guides for how to stake your BNB using some popular wallets: BNB Chain Wallet, Trust Wallet, MathWallet. Learn how to stake SOL and start earning rewards in simple steps with Trust Wallet. Download the Trust app today! To stake cryptocurrency in Trust Wallet, you can follow these steps: 1. Download and install Trust Wallet from your respective app store. Trust Wallet serves as a central hub for many activities on the blockchain – and if you use it exclusively, all your blockchain transaction history will be. With Trust Wallet, you can safely access dApps, store and manage your crypto and NFTs, purchase, sell, and stake crypto to receive incentives, and much more. This guide will walk you through the process, benefits, and potential rewards associated with staking USDT. Trust Wallet is a popular cryptocurrency wallet that supports staking on different blockchain networks. In this blog post, we will explore how to stake money. Key details for staking ETH using Trust Wallet · Minimum amount required for staking: ETH · Lockup period for staking: 4 days · Staking yield (APR). We've got you covered. Keep reading. Here's our detailed step-by-step guide to staking Cosmos ATOM tokens using Trust wallet. There is no minimum to stake (though there is a staking key deposit of 2 ADA) and any ADA added to your wallet is automatically staked. Join Pierre, Business Development Manager at Trust Wallet, for an engaging session as he shares insightful knowledge on Staking and on how to stake in Trust. Start staking $INJ in #TrustWallet today and earn rewards of over %! Head to the 'earn' tab in your Trust Wallet and dive into over Stake your Trust Wallet Token to maximize your TWT holdings that would otherwise be sitting in a wallet or trading account. We found for you the best exchange to stake Trust Wallet Token. ReHold, in our opinion, is the best place to earn rewards and generate passive income from your.

How Much Does Coin Star Charge

Coinstar® kiosks turn the coins you toss in a jar into something you really want - like cash, a eGift Card, or a charity donation. If you want to trade in your coins for cash, there is a % fee. Many people feel this is quite high, and decide to peruse the other fee-free options (see. At many stores, if you apply the transaction to a purchase from the store, there is no fee. Grocery stores do this and they seem to be the ones. Yes, there is a fee associated with using Coinstar machines. Customers must pay a service fee of % of the total value of the coins deposited. For example. “Coinstar is a proven, well-respected industry leader with a decades-long In the United States, consumers can convert their change to cash, a no-fee. For coin deposits, Coinstar charges a fee of 5% of the total amount deposited. For depositing bills directly into your checking account, there is a flat fee of. How much does Coinstar charge for exchanging my coins into cash? It costs % of your coins' worth to use Coinstar, however you may. You can alternately choose the gift card option that includes options such as amazon,walmart and itunes - you then pay no counting fee. there is even a third. Transaction Fee: 0% | Minimum amount: $ | Maximum amount: $2, Coinstar® kiosks turn the coins you toss in a jar into something you really want - like cash, a eGift Card, or a charity donation. If you want to trade in your coins for cash, there is a % fee. Many people feel this is quite high, and decide to peruse the other fee-free options (see. At many stores, if you apply the transaction to a purchase from the store, there is no fee. Grocery stores do this and they seem to be the ones. Yes, there is a fee associated with using Coinstar machines. Customers must pay a service fee of % of the total value of the coins deposited. For example. “Coinstar is a proven, well-respected industry leader with a decades-long In the United States, consumers can convert their change to cash, a no-fee. For coin deposits, Coinstar charges a fee of 5% of the total amount deposited. For depositing bills directly into your checking account, there is a flat fee of. How much does Coinstar charge for exchanging my coins into cash? It costs % of your coins' worth to use Coinstar, however you may. You can alternately choose the gift card option that includes options such as amazon,walmart and itunes - you then pay no counting fee. there is even a third. Transaction Fee: 0% | Minimum amount: $ | Maximum amount: $2,

And, best of all, you pay no service fee when you select this option. Caring through Coins Coinstar's Coins that Count® charity program gives you the option of. If you choose to get cash for your coins, you'll pay a 10% fee. But! If you cash your coins in for a gift card or you give your money to charity, there's no fee. Coinstar's focus is the conversion of loose change into paper currency, donations, and gift cards via coin counter kiosks which deduct a fee for conversion of. How does Coinstar work?Expand There is a 25p transaction fee and an % processing fee for cash transactions and an % fee for charity donations. In general, Coinstar's service fee is up to % and its transaction fee is 50 cents, but fees vary depending on the location. To avoid these fees, you'll. Hey, guys. So. I've got a lot of comments like this on my video. where I took my son to empty out his piggy bank. at the coin store. They charged us an % to. Coinstar kiosks in the U.S. offer many services but do not exchange gift cards or foreign currency. Exchange your coins for an eGift Card – many NO FEE. Coinstar kiosks in the U.S. offer many services but do not exchange gift cards or foreign currency. Fees vary by retailer, with many NO FEE options available. Did you know that the average coin jar holds $62? That's 62 bucks sitting around your house, just waiting to become something. Turn those coins into. I never knew this. Of course, they are just charging Amazon the 10%, and ultimately this gets passed back to the consumer (though much diluted). Coinstar machines charge for the service - the fee can vary, but the standard is a % processing fee for cash transactions and a 7% fee for. How does Coinstar® work? · Take your coins to a Coinstar machine. A % coin processing fee applies. Fees may vary by location. · Remove dirt, debris, and. As a valued member of our credit union, you'll incur a discounted fee of 5% when using Coinstar to deposit your change directly into your account. No, but every institution is different. You set the fee schedule and determine whether or not you want to charge your customers for the service. Also, some of. Coinstar charges a % fee now? That's lower than what it used to be. That's why they don't TELL you the charge on the console, they just let you find out. Did you know there are NO FEES at Coinstar machines when you cash in your coins for gift cards? If you have so much change in your purse that. Please note that Coinstar will charge our members a 5% convenience fee, which is lower than their usual % convenience fee for sorting and counting coin. Enjoy a variety of amenities such as Coinstar®, Western Union®, long-distance phone cards and much more! Coinstar® is a quick and easy way to turn your loose. How does Coinstar® work? · Choose one of our two convenient options: get cash, which has a 25p transaction fee and a % processing fee for cash transactions. Get more out of your coins with Coinstar · It's quick and convenient to turn coins into cash with Coinstar. (coin counting fees apply) · There's No Fee at.

What Happens When U Trade In A Car

If the trade-in offer is less than what you owe, the remaining balance can be rolled into your financing contract for the car you're purchasing. Either way, be. You can sometimes trade in a vehicle if you're behind on your loan payments – but it may depend on how far behind you are. The service department at a car dealership will do an overall inspection of a proposed trade vehicle. They'll examine the condition of brakes, tires, fluids. Yes, you can trade in your car even if you still owe money on the loan. Explore your trade-in options with Greg Hubler Hyundai to learn more. When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take over the loan, essentially buying the car. With Birchwood, you can get cash even if you still owe money on your car, and we take care of all of the paperwork. Even if your vehicle isn't in perfect. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. In the. Either way, be sure to verify that the dealership has paid off your current loan within 10 days to avoid your lender thinking you've lapsed on your car payments. If you trade your worn out older car in at a new car dealership, they will immediately ship it to the wholesale vehicle auction house with which. If the trade-in offer is less than what you owe, the remaining balance can be rolled into your financing contract for the car you're purchasing. Either way, be. You can sometimes trade in a vehicle if you're behind on your loan payments – but it may depend on how far behind you are. The service department at a car dealership will do an overall inspection of a proposed trade vehicle. They'll examine the condition of brakes, tires, fluids. Yes, you can trade in your car even if you still owe money on the loan. Explore your trade-in options with Greg Hubler Hyundai to learn more. When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take over the loan, essentially buying the car. With Birchwood, you can get cash even if you still owe money on your car, and we take care of all of the paperwork. Even if your vehicle isn't in perfect. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. In the. Either way, be sure to verify that the dealership has paid off your current loan within 10 days to avoid your lender thinking you've lapsed on your car payments. If you trade your worn out older car in at a new car dealership, they will immediately ship it to the wholesale vehicle auction house with which.

After all, if you owe more than your vehicle is worth, it can be costly to trade in. This is because your loan doesn't just disappear when you trade in your. When you roll over a loan you are adding the remaining amount of your existing loan payments to the new loan for your next vehicle. This folds in what you owe. As long as the damage isn't extensive like missing bumpers and shredded fenders, you can trade in a car with body damage and not worry about completing repairs. You can trade in a car that you still owe money on though it will take a bit more effort. Let us show you what you need to know before you get started! You'll agree on a trade value with the dealer and they will pay off your loan for you, and the rest of the trade value will go towards the new. This equity can be used as credit toward your new car purchase. If you owe more on your loan than the trade-in value, you're in a situation known as "negative. When you owe more than what your vehicle is worth, you'll get the money for your vehicle's value and have to decide what to do about the difference. This leaves. You will get less money than selling it yourself. At best, you should expect to get the vehicle's wholesale value. You can use the trade-in amount as the down. The answer is yes, but there are some things to keep in mind. However, trading in a financed car can be a great choice for many drivers. If you owe $6, on your car and its trade-in value is $8,, you have $2, in positive equity that can be put toward the purchase of another car. Positive. The depreciation that occurs when you leave the dealership means your trade-in will have less value than a new vehicle, even though it's practically new. If you. If you decide to sell your vehicle privately, you will pay tax on the sale, but if you trade it in to a dealership towards the purchase of a new vehicle, that. A trade-in happens when you sell your current vehicle to a dealership and then use the value of that car as part of a down payment towards a new-to-you purchase. If the remainder on your loan is less than the trade-in offer, you'll have money leftover. For example, if you still owe $7, on your car in Orangeville, and. When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take over the loan, essentially buying the car. Even if your trade-in car is not paid off yet, the main factors that any dealership account for are the mileage of the vehicle, the vehicle type, the history of. What actually happens, is that the amount owed on your original loan is added to your new loan. Essentially, when you roll-over a loan, your payments will both. If you're trading in a car you still owe money on, the first thing you need to do is determine whether you have positive or negative equity in your vehicle. The. You are still responsible for the balance. Learn more about your options for trading in a car that still has a loan balance with Sterling Acura of Austin. Our. Yes! However, it is important to understand that you still have to pay off the balance on your car loan, as it does not disappear because you've traded it in.

Top Insurance Companies In Oklahoma

WalletHub selected 's best car insurance companies in Oklahoma based on user reviews. Compare and find the best car insurance of RateForce makes it easy to get a free quote for car insurance in Oklahoma. Compare rates from top insurers and find best coverage for your needs. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. Compare 50+ top insurance companies including Progressive, Travelers, AAA, Nationwide (and more!) to find the best and cheapest car insurance in Oklahoma. Independent insurance agency in Oklahoma City, Oklahoma offering auto, home, business, life and personal lines insurance services. Below are the Top Insurance companies In Oklahoma and their top employee and management contact details. Top Oklahoma City, OK Insurance Companies (4) · CompSource Mutual Insurance Company · Comma Insurance · BancFirst Corporation · One General Agency. Insurance. Best Life Insurance Companies in Oklahoma City ; Conway Insurance. Harmony Dr, Midwest City, OK · Review Sources. Yelp: (22); Facebook: (3). Top Insurance Companies in Oklahoma City, OK · Filter Companies · State Farm · Liberty Mutual Insurance · Progressive Insurance · CSAA Insurance Group, a AAA. WalletHub selected 's best car insurance companies in Oklahoma based on user reviews. Compare and find the best car insurance of RateForce makes it easy to get a free quote for car insurance in Oklahoma. Compare rates from top insurers and find best coverage for your needs. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded to. Compare 50+ top insurance companies including Progressive, Travelers, AAA, Nationwide (and more!) to find the best and cheapest car insurance in Oklahoma. Independent insurance agency in Oklahoma City, Oklahoma offering auto, home, business, life and personal lines insurance services. Below are the Top Insurance companies In Oklahoma and their top employee and management contact details. Top Oklahoma City, OK Insurance Companies (4) · CompSource Mutual Insurance Company · Comma Insurance · BancFirst Corporation · One General Agency. Insurance. Best Life Insurance Companies in Oklahoma City ; Conway Insurance. Harmony Dr, Midwest City, OK · Review Sources. Yelp: (22); Facebook: (3). Top Insurance Companies in Oklahoma City, OK · Filter Companies · State Farm · Liberty Mutual Insurance · Progressive Insurance · CSAA Insurance Group, a AAA.

J W Kempton & Asso - Oklahoma City, OK. Oklahoma, Oklahoma City ; Nextep, Inc. - Oklahoma City, OK. Oklahoma, Norman ; Bancfirst Insurance. We Protect Oklahomans Best. · No other insurance companies understand life in Oklahoma like we do. · And here's what we offer to help you live it to the fullest. For drivers with an at-fault accident, Safeco is a top contender for affordable auto coverage. The company has some of the lowest rates in Oklahoma City and. BBB Accredited Insurance Companies near Oklahoma City, OK. BBB Start with Trust ®. Your guide to trusted BBB Ratings, customer reviews and BBB Accredited. FARMERS INSURANCE COMPANY (**Mid-Century Insurance Company). A-Male, $8, Oklahoma Insurance Department NE 50th Street, Oklahoma City, OK AFR Insurance Named on the Forbes America's Best Insurance Companies List. Oklahoma City, Oklahoma. – AFR Insurance has been awarded on the Forbes list. The best insurance companies to work for in Oklahoma City, OK are American Fidelity, Claims Management Resources, American Farmers & Ranchers Mutual. Individual and Family Health Insurance Companies in Oklahoma · Blue Cross and Blue Shield of Oklahoma · HS - Ambetter of Oklahoma · HS - Blue Cross and Blue Shield. SelectQuote works with trusted home and auto insurance companies throughout Oklahoma to deliver high quality policies at affordable rates. When you let. Top 21 auto insurance companies in Oklahoma · 1. Jack W Booth & Associates · 2. Glenn Harris & Associates, Inc. · 3. Daemi Group of Oklahoma · 4. Above All. Cheapest Car Insurance Rates in Oklahoma for Good Drivers: USAA and State Farm. Oklahomans with a clean driving record pay, on average, $1, a year for car. With a high Insurify Quality (IQ) Score of out of 10, an AM Best financial strength rating of A++ (Superior), and customizable coverage options, State Farm. First American Title Ins Co. Title Companies, Insurance Companies, Title Agent · () NW 8th Street ; Auto Insurance Center. Insurance Companies · . Nerdy takeaways · Geico offers the cheapest full coverage in Oklahoma, with an average rate of $1, per year according to NerdWallet's August analysis. Top 10 Best Insurance Near Oklahoma City, Oklahoma · 1. Oklahoma Insurance Group. (1 review). Home & Rental Insurance · 2. Chris Baxter Insurance. (1. The Beckman Company provides insurance by industry, business, personal, and employee benefits solutions to Oklahoma and beyond. OKC Insurance Brokers is an independent insurance agency that represents multiple top-rated insurance companies. We're proud to serve Oklahoma and Texas. Make. WalletHub selected 's best life insurance companies in Oklahoma based on user reviews. Compare and find the best life insurance of Great Plains Insurance; One of the best insurance companies in Oklahoma! Give Great Plains Insurance a call for all your Oklahoma personal insurance needs!

Highest Paid Engineering Field

Here are the best engineering jobs: Mechanical Engineer; Environmental Engineer; Biomedical Engineer; Civil Engineer; Cartographer; Architect; Petroleum. Highest Paying Engineering Jobs in Australia · 1. Engineering Manager · 2. Project Engineer · 3. Aerospace Engineer · 4. Mechanical Engineer · 5. Civil Engineer · 6. Architectural Engineer – $50, - $90, · Biomedical Engineer – $50, - $92, · Civil Engineer – $51, - $93, · System Engineer -. Year after year, engineering jobs are paid the highest average starting salary. field projects to have employment growth of 6 percent from to At $, per year, computer hardware engineers earn the most on average, followed by petroleum engineers and aerospace engineers. What are the Highest Paying Engineering Jobs? · #1 Engineering Manager · #2 Computer Hardware Engineer · #3 Aerospace Engineer · #4 Nuclear Engineer · #5 Chemical. I'd look at job titles such as systems design engineer, programmer, or applications engineer if you're looking for more of a desk job. The specialty of vehicle engineering, this area deals with the development of aircraft and spacecraft. For a career in engineering in this field you need a. Top paying states for nuclear engineers included New Mexico, New York, and Washington, DC. The industry employs some 13, professionals, and the decade is. Here are the best engineering jobs: Mechanical Engineer; Environmental Engineer; Biomedical Engineer; Civil Engineer; Cartographer; Architect; Petroleum. Highest Paying Engineering Jobs in Australia · 1. Engineering Manager · 2. Project Engineer · 3. Aerospace Engineer · 4. Mechanical Engineer · 5. Civil Engineer · 6. Architectural Engineer – $50, - $90, · Biomedical Engineer – $50, - $92, · Civil Engineer – $51, - $93, · System Engineer -. Year after year, engineering jobs are paid the highest average starting salary. field projects to have employment growth of 6 percent from to At $, per year, computer hardware engineers earn the most on average, followed by petroleum engineers and aerospace engineers. What are the Highest Paying Engineering Jobs? · #1 Engineering Manager · #2 Computer Hardware Engineer · #3 Aerospace Engineer · #4 Nuclear Engineer · #5 Chemical. I'd look at job titles such as systems design engineer, programmer, or applications engineer if you're looking for more of a desk job. The specialty of vehicle engineering, this area deals with the development of aircraft and spacecraft. For a career in engineering in this field you need a. Top paying states for nuclear engineers included New Mexico, New York, and Washington, DC. The industry employs some 13, professionals, and the decade is.

Engineering dominates as the field with top starting salaries. Explore diverse engineering salaries, see what engineers make worldwide! What are the Highest Paying Engineering Jobs? · #1 Engineering Manager · #2 Computer Hardware Engineer · #3 Aerospace Engineer · #4 Nuclear Engineer · #5 Chemical. Petroleum engineering is arguably the best paying engineer job, with the mean annual income of petroleum engineers being $, Top 3 recruiters for. In the electrical engineering sector, top-paying companies like Google, Tesla, and Intel set the benchmark with salary ranges from $, to $, Engineers get top pay. According to the U.S. Bureau of Labor Statistics (BLS) engineers have a median annual wage of $ The engineering field projects. Engineers get top pay. According to the U.S. Bureau of Labor Statistics (BLS) engineers have a median annual wage of $ The engineering field projects. Aero-space engineers are the highest paid and has quick growth rate of 25% yearly. But this has a upper limit, initial 10yrs of service has good. Petroleum engineering is arguably the best paying engineer job, with the mean annual income of petroleum engineers being $, Top 3 recruiters for. Engineering dominates as the field with top starting salaries. Explore diverse engineering salaries, see what engineers make worldwide! Highest Paid Engineering jobs · Boiler Operator/4th Class Engineer. Bullitt Staffing Inc · Program Director. New · Electronics Production Manager. Rimex Supply. Highest Paying Field Engineer Jobs (August ) Earn up to $k/yr as a Commissioning Manager, Commissioning Engineer or Senior Field Service Engineer. Highest Paid Engineering Jobs · Petroleum Engineering · Electrical Engineering · Computer Engineering · Aerospace Engineering · Chemical Engineering · Materials. Of the four main branches of engineering, chemical engineering commands the highest salary. On the lower end of the spectrum, chemical engineers can pull off an. Electrical engineers can also help develop products, like GPS devices or smartphones. Once you make your way into the field, you could earn the median annual. Civil Engineering constituted about 23% of these jobs following closely are mechanical and industrial engineering contributing to 36% of the. The project engineer is one of the highest paying engineering jobs due to the fact it combines engineering and business management skills. Jobs for this role. With around 38, petroleum engineers working around the world, their average annual salary is $, As the highest paid engineering job available today. Therefore, of these three areas of engineering, computer technology engineers have the highest pay on average. California, Washington D.C., Maryland, and. Earning a median salary of $,, petroleum engineers top the list of top paid jobs in the field. Petroleum Engineers help locate new sources of natural gas. The specialty of vehicle engineering, this area deals with the development of aircraft and spacecraft. For a career in engineering in this field you need a.